Y Combinator-backed startup San Francisco Open Exchange (SFOX) is an online trading platform that helps people find the best bitcoin prices at various exchanges. In other words, it would like to help you buy, sell and invest in bitcoin exchanges kinda like and investor buys and sells stock on E-Trade.

Co-founder Akbar Thobhani left his job at Airbnb to create this platform. However, he soon found that using bitcoin was even more expensive than using credit cards. This is because there’s not a lot of transparency. So he started thinking that if he could find a way to compare prices this would help drive widespread adoption for the bitcoin market.

There are similar systems that directly buy and sell. CampBX, based in Atlanta, is one of many hundreds of exchanges out there that allow buying and selling. Although, Thobhani says CampBX is a different business because it’s just one exchange on a closed system. “Our goal is simple – find our customers the best price for their bitcoin. To do this, we work with multiple exchanges and use our algorithms to route the transactions,” Thobhani explained in an email.

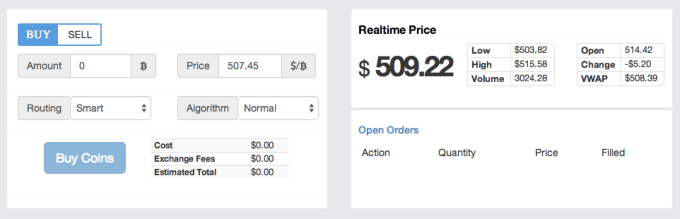

The key thing to understand here is that SFOX does not actually allow you to buy or sell bitcoin directly, like CampBX or other exchanges. Rather, it is a platform which facilitates finding the best price on these exchanges. Prices can vary wildly, depending on the exchange used. One bitcoin could be $508.58 on Coinbase but $507.90 on Coindesk or $508.50 on Bitstamp.

There’s also the btcReport app for iOS. However, this app merely shares information about the different prices on different exchanges. It does not allow someone to actually buy or sell bitcoin. This is what makes SFOX unique in the market. It actually finds the prices on different exchanges and then, like a stock exchange platform, facilitates the trade. It also allows you to use standard equity trading features like limit orders, just like someone might find on a platform like E-Trade or Charles Schwabb.

Another thing that SFOX attempts to solve is the location of where the exchanges exist. According to SFOX, 90 percent of all bitcoin trades are done in the U.S. However, the most popular exchanges like Bitstamp and BTC-e are based outside of the U.S. The problem is some exchanges have failed to adhere to U.S. currency regulations. The now infamous Mt. Gox was one such exchange that has faced this very issue. The U.S. Department of Homeland Security issued a warrant to seize money from Mt. Gox’s US subsidiary’s account with payment processor Dwolla in 2013. The Tokyo, Japan-based exchange was at one point handling 70 percent of all bitcoin transactions. But then it announced that around 850,000 bitcoins had gone missing and were likely stolen. The amount of missing bitcoins was valued at more than $450 million at the time. Mt. Gox didn’t register in the U.S. as a money transmitting company, which is a requirement for U.S. money services and Dwolla had no choice but to comply with handing over the money. SFOX, which is based in the Bay area, claims to be in line with U.S. regulations.

Thobhani and his co-founder George Melika’s idea was pretty well received at last week’s YC Demo Day, too. We asked around to a few investors during the breaks which company they were most impressed with. Many of them mentioned SFOX. The company is now in several talks with potential investors.

Thobani hints at possibly adding other cryptocurrencies such as dogecoin and litecoin to the platform. He also says SFOX could go international at some point.

Trading in SFOX is currently by invitation only.

It's a tough field though. Nowadays, there are many exchanges (Kraken, Binance, etc.), and if we are speaking of large amounts, there are also quite a few OTC brokers out there, thejingstock.com/ these guys for example.

ReplyDeleteadding the link so you don't have to google

ReplyDeleteKraken

Binance

GingStock